Executive Summary

Customer Profile

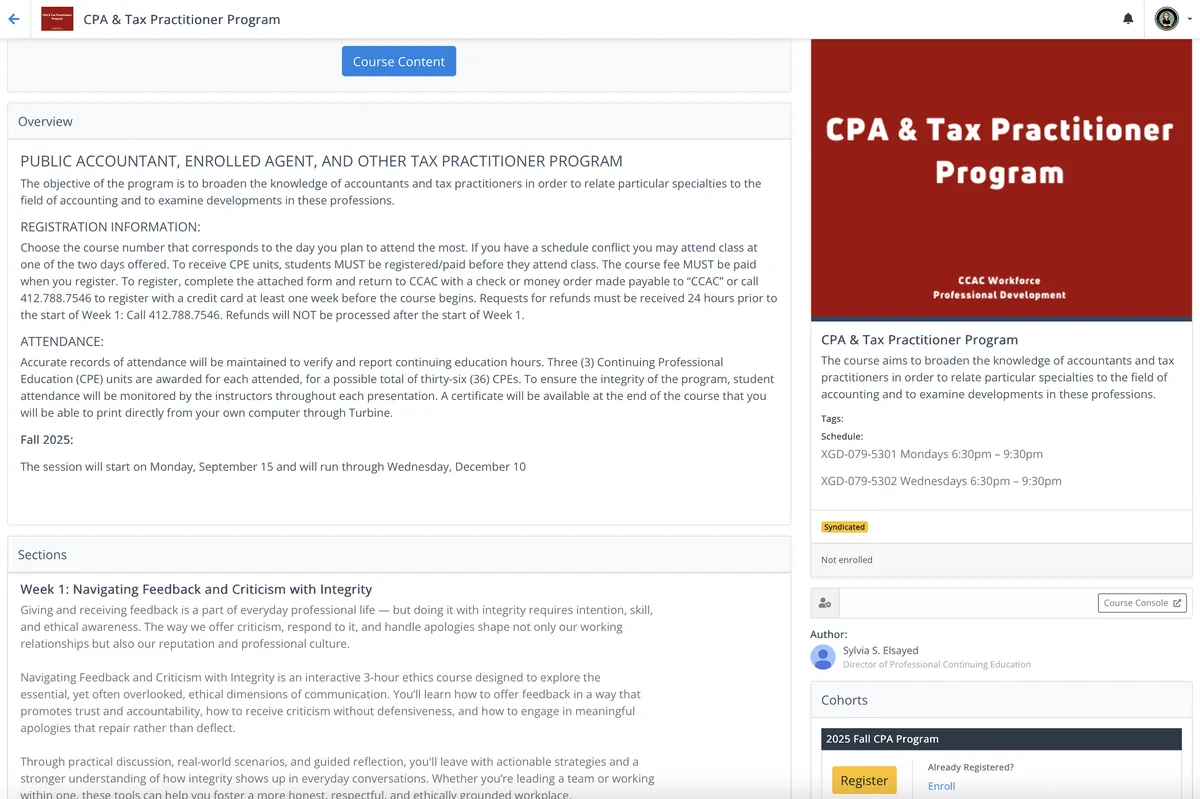

CCAC Workforce Professional Development (Continuing Education)

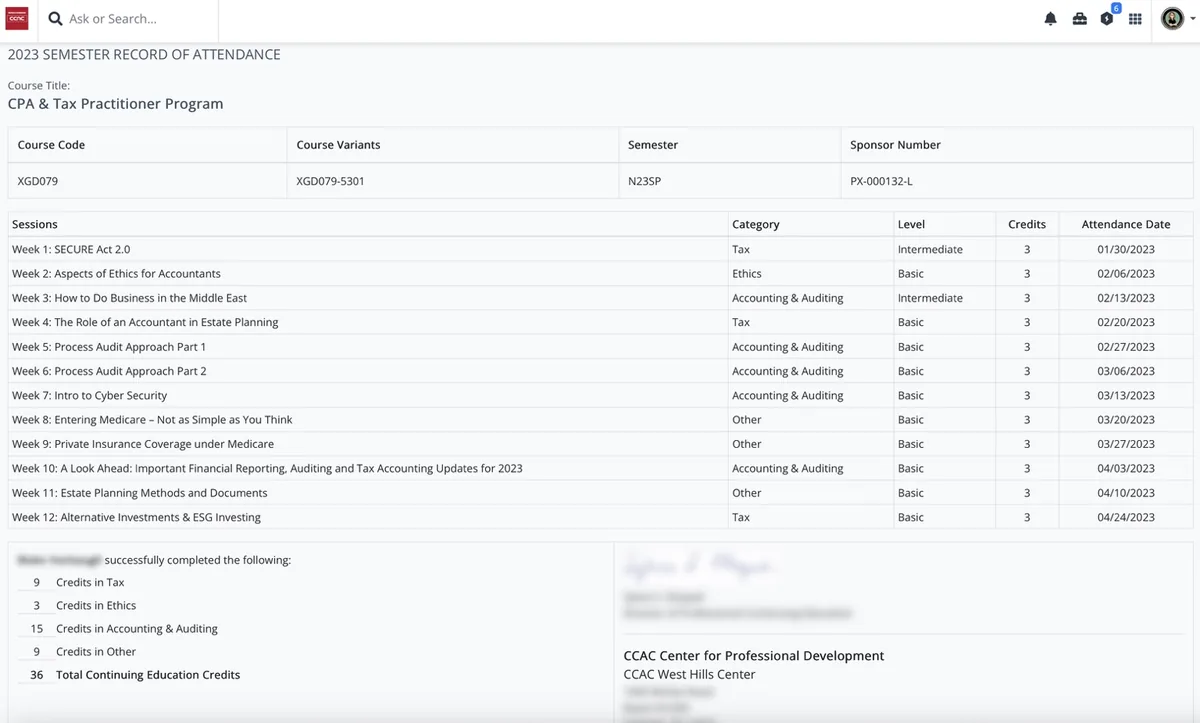

CPA & Tax Practitioner Program

Weekly sessions (12-week structure), offered in multiple course variants (e.g., Monday vs. Wednesday schedule)

The Challenge

Continuing education programs need to reliably answer a few high-stakes questions every term:

Without a unified system, these questions require manual data assembly every term.

The Turbine Solution

The course page centralizes all program information with weekly sections aligned to the semester plan:

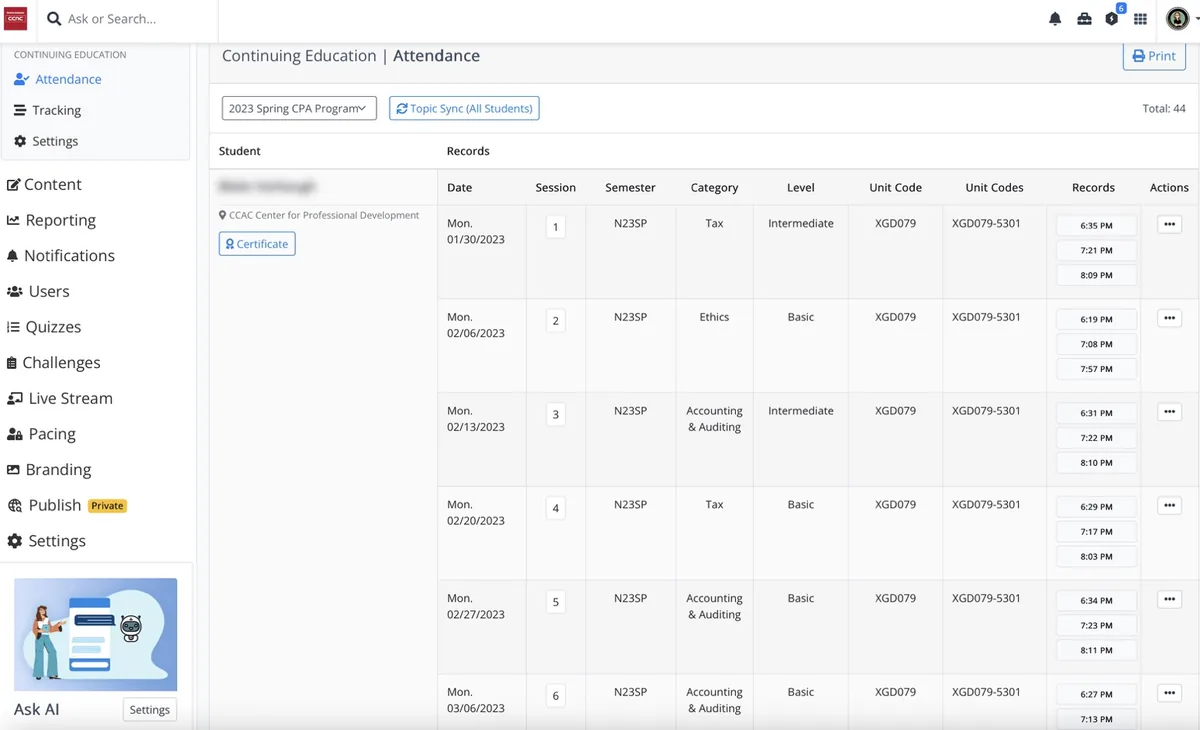

In Continuing Education → Attendance, CCAC staff view participation by learner and by session/date, with rich session attributes:

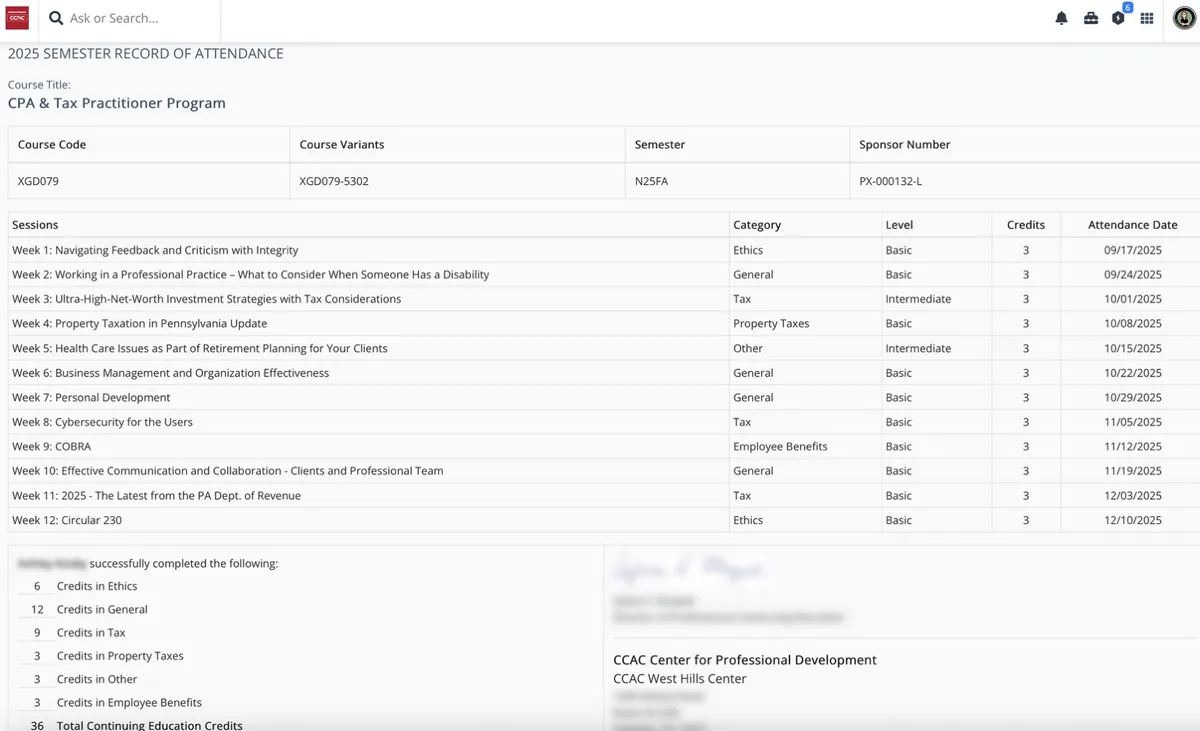

Turbine generates a Semester Record of Attendance that consolidates:

Example Semester Total

36 CPE Credits

across 12 sessions (3 credits each)

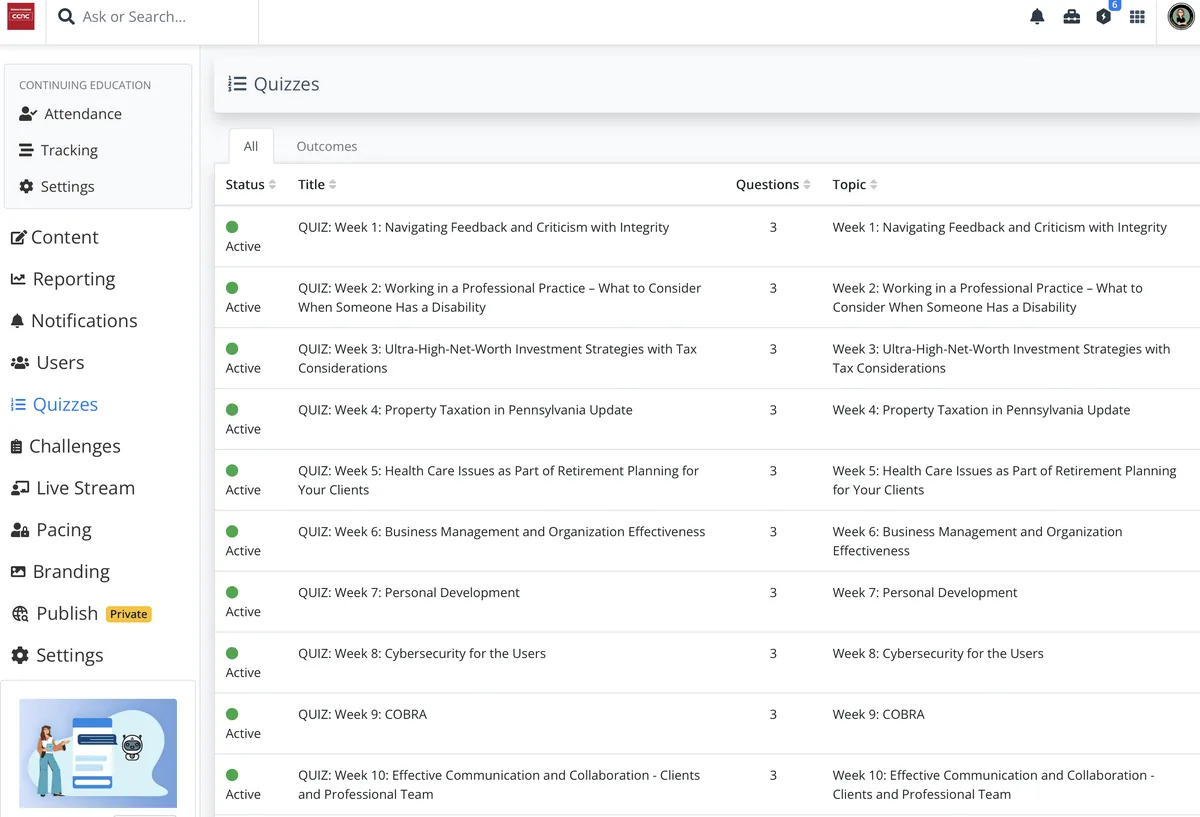

In Quizzes, CCAC maintains an active quiz for each weekly topic:

Implementation Highlights

Outcomes

The Bottom Line

Ready to streamline your CPE program?

See how Turbine Workforce can transform attendance tracking and credit reporting for your continuing education programs.

Schedule a Demo →